June's Industry Dirt

Like your favorite sequel, I’m back, giving you more of the same but different news that finds itself at the intersection of entertainment and commercial real estate (CRE).

If you missed last month’s inaugural Industry Dirt issue, here it is.

Otherwise, let’s get to it!

OUT WITH THE OLD, IN WITH THE NEW

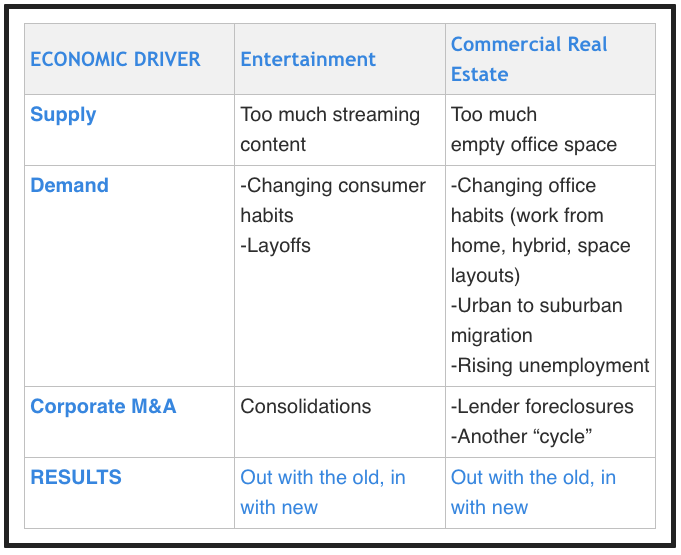

Maybe I’m having a rare poetic moment, but the entertainment industry and commercial real estate sure seem to rhyme in mid-2024.

Both industries are navigating new terrain, driven by changing consumer tastes in entertainment and, in commercial real estate, employees' shifting preferences for the kind of physical space in which they prefer to work.

A perfect example of these trends is Skydance’s bid for Paramount. A (somewhat) new player, David Ellison, buying an old player (Redstone) out.

For us real estate types, we foresee (hope for) not only a re-energized media firm but also a rethinking of the century-old Paramount Lot in Hollywood. This amazing 65-acre asset has many possibilities to maximize value while maintaining its history and, with the new capital, being upgraded to suit today’s entertainment economy.

We shall see how Redstone reacts to the next suitors: Edgar Bronfman Jr., backed by Bain Capital, and Hollywood producer Steven Paul, who was lining up financing for a bid. Paramount Global’s stock tanking after Redstone turned down Skydance reveals a lot about what the market thought of the deal and perhaps Paramount Global.

TODAY’S LOS ANGELES ENTERTAINMENT & CRE ENVIRONMENTS

Entertainment and CRE are running oddly parallel existences in 2024

It is obviously too early to tell if the new owners of the Paramount lot will do what CBS did in Studio City (outright sale to a developer) or what Fox is doing in Century City (repurposing underutilized portions to maximize value via FOX FUTURE), but what’s going on in Santa Monica may influence the decisions at 5555 Melrose Ave.

Over in Santa Monica, where Skydance bought the former Lantana Center in 2019, and the elder Ellison owns the office building at 2700 Colorado Ave occupied by Lionsgate (renewed earlier this year for 153,210 RSF and a 49-month term), could we see a new office space requirement from the recently spun-off Starz?

All this to say, depending on who buys Paramount can have all sorts of ripple effects in the office market. Which LA submarket will be the winner? Loser? It’s too early to tell, but hopefully, the rare win-win scenario in entertainment will unfold.

More.

Since the non-Paramount deal isn’t quite enough drama, note that Ellison teamed with RedBird’s Jeff Zucker to buy the studio. This isn’t RedBird’s first acquisition of an LA entertainment concern. In February, RedBird (presumably named after its Managing Partner, Gerry Cardinale—using Latin and, in the avian context, a red bird) bought All 3 Media located at the Hughes Center, now called the Playa District (6060 Center Drive)--a group of high rises just west of the 405 just before Marina Del Rey. Despite the rebranding, which is a stretch (kinda like the “Los Angeles” Angels), this project is headed to foreclosure and will shortly no longer be owned by the Blackstone-controlled EQ Office.

All 3 Media’s three floors look to be already available in an office asset headed back to its lender. RedBird also owns Media Res at 6255 Sunset Blvd up on the 22nd floor. What happens there?

All 3 Media’s Playa District space is on the market. (source: Costar)

Meanwhile, Google, like the other FANG companies, flocked to LA as they ramped up their streaming and film operations. At one point, there wasn't enough office space to accommodate their demand. Now, companies like Netflix and Google are unwinding some large leases by subleasing space or, in the case of Google, terminating leases. I would imagine the value of the west LA Google lease exceeded $1B.

It’s not a stretch to say that in a city built on the back of drama, some of the best is happening right now up in the C-suites.

TWO NEW STUDIOS AND SOME CRE NEWS

Rendering of the East Tower at Echelon Studios.

Urbanize LA reports on Echelon Studios, a joint venture between Bardas Investment Group and Bain Capital Real Estate, will span a full city block at 5601 W. Santa Monica Blvd in Hollywood. Work on the complex, which began earlier this year, calls for the construction of multiple buildings containing a combined total of:

110,000 square feet of production studios and support space;

more than 388,000 square feet of offices;

over 12,300 square feet of ground-floor restaurant space; and

parking for 981 vehicles on two subterranean levels.

Barda’s building will be beautiful and cutting edge, and counterintuitively, there isn’t a lot of this type of product around despite the “work from home” created vacancies. Out with Blackstone, in with Bain Capital.

The Real Deal reports that a religious institution has bought 7083 Hollywood Blvd. We can confirm that the Church of Scientology bought the former WeWork-anchored building, removing “office supply” from the Hollywood submarket. Not that this building had many tenants, anyway. This building is the typical 1980s build and is best suited for “other uses.”

Risa Heller Communications is expanding to Los Angeles. The communications consultancy, which specializes in high-stakes and high-profile crisis, reputation, and corporate communications matters, is bringing on Erika Masonhall to serve as managing director of the new office. (source: Hollywood Reporter)

Wildflower Studios, a film studio co-owned by Robert De Niro, has named Cheryl Huggins as executive director ahead of a July 1 opening. Huggins, who completed earlier executive stints with Quixote Studios (sold to REIT Hudson Pacific Properties (NYSE: HPP)) and Sunset Studios, will oversee operations at the 11 soundstage, 765,000 square foot studio campus in Astoria, Queens. The new studio campus is set on a five-acre site once owned by piano maker Steinway & Sons and is near rival Queens film production complexes Kaufman Astoria Studios and Silvercup Studios. Together, the local film studios are looking to help New York City pick up production from Los Angeles, especially from major streamers, as the entertainment industry recovers from the dual Hollywood actors and writers strikes last year. (source: Hollywood Reporter)

Rendering of a re-imagined Television City.

And while we’re at it, check out the renderings of the $1 billion renovation of the former CBS Corporation-owned Television City right off of Beverly Blvd. The new plan embraces architect William Pereira’s original vision, which focused on flexibility and adaptability and called for the eventual development of dozens of stages and multi‐story office towers. The TVC plan builds upon Pereira’s futuristic vision, allowing the studio to accommodate evolving technologies and industry demands.

THE DOUGLAS EMMETT DILEMMA

If you’re currently a tenant in a Douglas Emmett (NYSE: DEI) owned building, you might not want to skip this section. I recently listened to their earnings call and learned a couple of interesting facts that might help you with your bigger $ lease points. More on that in a moment.

Here are my key takeaways from the DEI call:

DEI leased 1.2M square feet last quarter in 214 transactions, mostly renewals. Why are so many tenants renewing…

Their tenants are not only receiving lower rents, but higher concessions: “total leasing costs" up to $6.11 per square foot per year of the lease term (i.e., 10-year term=$61.10 per square foot concession)

One of DEI's largest tenants, Warner Brothers, will vacate the entire building at 3400 Riverside, Burbank. The Reason: Discovery/Warner’s corporate activity is somewhat related to the entertainment industry’s malaise and resulting corporate consolidations. Note that this is unrelated to the work-from-home trend, which seems to be fading in popularity.

What’s in it for you (your gameplan):

Tenants who create a strategy well before their critical lease dates (option deadline/lease expiration) can (i) lower base rents, (ii) reset operating expense pass-throughs, and (iii) garner higher Tenant Improvement contributions.

You might want to consider exploring the idea of a move-in-ready, fully furnished sublease with plenty of remaining term length in order to create great negotiating leverage with your landlord (Douglas Emmett, in this case). ← I can be of great help here. Reach out to discuss.

ON THE MARKET

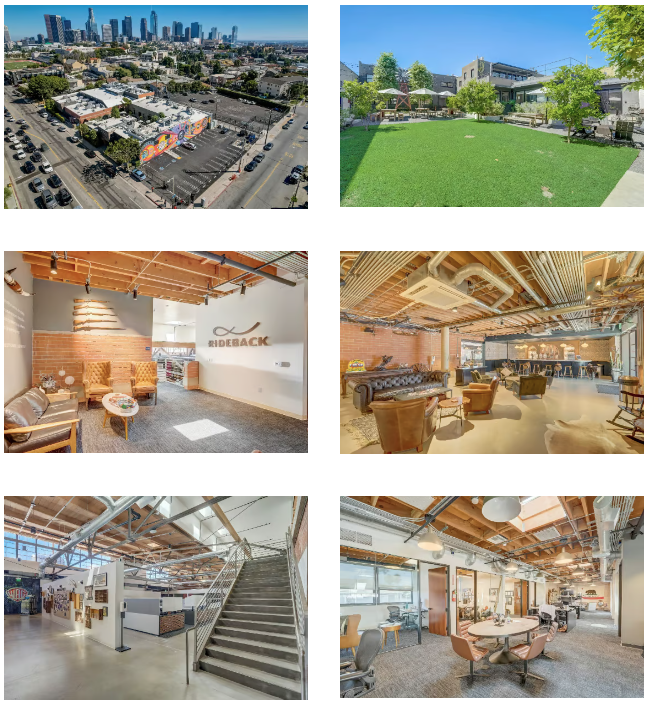

Much was made about Dan Lin’s move to head up film at Netflix, but what will happen to the office space of his prodco, Rideback Ranch, in Historic Filipinotown (Echo Park adjacent)?

The low-rise campus features improvements by Boto Design Architects for a variety of media/post-production uses. The total of 25,997 SF in two buildings is divisible into multiple sizes and is available now.

Some highlights include courtyards, personal balconies, key card access, a secured parking lot, bow-truss building, high ceilings, and light-filled, operable windows.

Let me know if you’re interested in finding out more information or would like a tour.

Here are some pics:

DARE I SAY “INSPO”

I’ve always enjoyed Architectural Digest’s look at the Try Guys 5,000 square foot Burbank office. It’s certainly eclectic, but it works.

Located one block from UTA’s Beverly Hills headquarters, the RIOS-designed UTA Bungalows are a vibe.

Thanks for reading. If you want me to look into something or have some ideas for the newsletter, let me know, and I’ll get right back to you.

Ted Simpson

Founder and CEO

Commercial Real Estate Advisors

(c) +1 310.384.6512 |(e) ted@crea-la.com

CA DRE License #0109718